As government shutdown drags on, Mississippi healthcare crisis deepens

As the federal government enters its third week of shutdown, few states have more at stake than Mississippi.

At the heart of the impasse in Washington, D.C. lies a single issue: whether to preserve the expanded Affordable Care Act (ACA) tax credits that, for the past five years, have helped between 22 million and 24 million low- and middle-income Americans afford health insurance.

Unless Congress extends the subsidies before they expire on Dec. 31, 2025, millions of Americans will face the largest single-year premium price hike in U.S. history, according to Jeanne Lambrew director of health care reform and senior fellow at the Century Foundation, a New York-based progressive, independent think tank.

“The overwhelming majority of marketplace enrollees are working-class Americans who cannot afford such an extreme price hike,” Lambrew wrote in an Oct. 8 report.

Roughly 320,000 Mississippians would lose the enhanced tax subsidy and face some of the steepest premium hikes in the country. Combined with nearly $1 trillion in Medicaid cuts contained in President Donald Trump’s recently signed One Big Beautiful Bill Act, the loss of healthcare coverage and hospital revenue could devastate one of the nation’s most fragile health systems.

Nationwide, 16 million people are projected to lose healthcare coverage between the end of the 2026 and 2034 due to the expiration of the ACA tax subsidies and Medicaid cuts.

The stakes are high

Democrats and Republicans remain locked in a stalemate over how to end the shutdown. Republicans favor passing a short-term spending measure, known as a continuing resolution, to reopen the government while negotiations over a budget and the ACA subsidies continue. Democrats, however, refuse to move forward without a guarantee that the ACA’s enhanced tax credits will remain in place beyond 2026. Without the credits, healthcare premium payments will more than double nationwide, according to an analysis by the Kaiser Family Foundation, an independent San Francisco-based healthcare policy non-profit organization.

Mississippians are projected to see a 314 percent healthcare premium surge, the fifth-highest in the country, according to the Center for American Progress.

“Many Mississippians will feel this burden if Republicans don’t extend the Democratic tax credits that make health care affordable,” U.S. Representative Bennie Thompson, Democrat of Mississippi, wrote in an Oct. 11 social media post. He cited an example of a 54-year-old small business owner earning $50,000 who could see her premiums soar from $270 to $890 a month, an increase of more than $7,400 a year.

Earlier this month, Thompson told Mississippi Public Broadcasting that healthcare coverage for most of the 81,000 people who use the subsidies in his district would become unaffordable, while Medicaid cuts set to start after next year’s midterm elections would force eight hospitals to close.

“Republicans don’t care about fixing healthcare,” Thompson added in his post.

In response, Republicans in Mississippi’s congressional delegation have blamed Democrats for prolonging the shutdown. U.S. Sen. Roger Wicker accused them of “holding the funding process hostage,” while Rep. Trent Kelly said they were “choosing politics over the American people.” Sen. Cindy Hyde-Smith placed the blame squarely on Obamacare for the rising cost of health insurance and said Democrats had rejected “common-sense solutions in favor of political games.”

Republican states face the harshest fallout

However, there is a certain irony in Hyde-Smith’s claim. The states that benefited most under the enhanced tax credits and are most likely to suffer most from their expiration are overwhelmingly Republican-led. The subsidies, first introduced in 2014, were broadened under President Joe Biden during the pandemic to help more people meet income requirements in order to qualify for affordable health insurance. Participation more than doubled, jumping from 11.4 million to 24.3 million between 2021 and 2025.

Nearly 90 percent of that growth occurred in red states that Trump carried in 2024. Of the 15 states where marketplace health insurance plans increased the most, all were won by Trump.

Mississippi saw one of the sharpest enrollment hikes, increasing by 242 percent, second only to Texas, according to KFF.

While Republicans are adamant about allowing the subsidies to expire, GOP voters want them to increase.

A recent poll found that more than three-quarters of adults believe Congress should extend the ACA tax credits. That includes 92 percent of Democrats, 82 percent of Independents and nearly 60 percent of Republicans. While public sentiment to retain the benefit is high, some experts think they should be allowed to expire.

“Biden’s pandemic-era Obamacare premium subsidies were sold as temporary relief but have instead produced fraud, phantom enrollees, and subsidies for wealthy taxpayers who don’t need them,” wrote Adam N. Michel, director of tax policy studies at the Cato Institute, a Washington D.C.-based libertarian think tank, in an Oct. 3, 2025, analysis. “The program funnels billions of taxpayer dollars to insurers and middlemen while distorting the individual market and doing little to expand meaningful access to care.”

The Medicaid squeeze

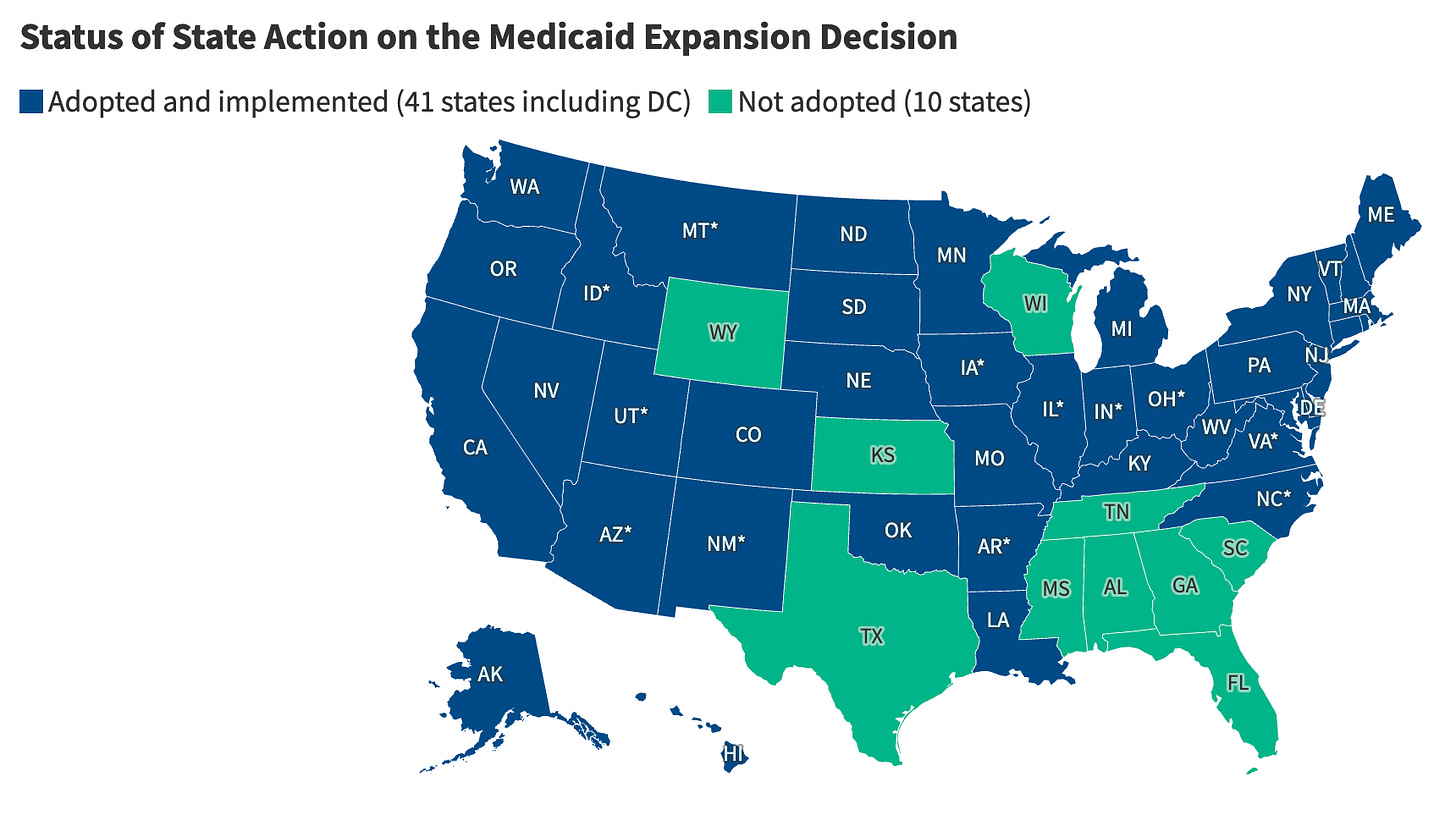

The problem runs deeper than just the ACA subsidies. In states that expanded Medicaid, adults with low incomes, up to about 138 percent of the poverty line, or roughly $21,500 a year for one person, qualify for government coverage. In states that didn’t, the income threshold is far lower, leaving hundreds of thousands in a coverage gap: too poor to afford private insurance, but too wealthy for Medicaid.

The enhanced ACA tax subsidies temporarily filled that coverage gap. If that disappears, there will be no safety net.

Around 667,000 children and adults use Medicaid in Mississippi.

Even before the current crisis, Mississippi’s Medicaid eligibility rules were among the nation’s most restrictive. Those collecting social security, aged over 65, disabled or pregnant are automatically covered. Parents in Mississippi can qualify if their income is at 27 percent of the federal poverty level, translating to about $7,230 annually for a family of three.

Without the subsidies, even some of the state’s poorest and neediest will not qualify for Medicaid. A single mother earning $8,000, for example, won’t qualify, but her children will.

Mississippi’s reliance on Medicaid makes it especially vulnerable to cuts in some ways and less so in others. By not expanding Medicaid, which would have increased the number of Mississippians with health coverage, the state avoids making some of the biggest cuts. On the other hand, the people who are using Medicaid are among the poorest in the country and will still face stricter conditions as the cuts take their course over the next decade, largely by imposing new work-reporting rules and administrative hurdles that lead to disenrollment.

In total, Mississippi will lose $5.4 billion in federal Medicaid funding over the next decade, and see about 46,000 people lose healthcare coverage. While that figure may seem comparatively low, cuts to vital services and the effect on the state medical institutions will hit rural and communities of color hardest.

Interestingly, most of the states projected to see the sharpest healthcare premium hikes--Mississippi, Alabama, Texas, South Carolina, Tennessee, and Wyoming--are also those that have rejected Medicaid expansion.

But economic cuts facing Mississippi’s poorest extend well beyond healthcare. According to CAP, the law will also slash SNAP food assistance, putting 33,000 Mississippians at risk of losing benefits while forcing the state to shoulder $125 million in new costs by 2028. It terminates key clean-energy and efficiency incentives, raising household electricity bills by an average of $160 a year and adding thousands to the cost of home upgrades. Student loan borrowers could see monthly payments rise by up to $300, while new homeowners will pay nearly $10,000 more over the life of a typical mortgage. Small-business loans, too, will become more expensive.

Hospitals on the brink

Nationwide, hospitals are expected to face $32.1 billion in lost revenue and a $7.7 billion rise in uncompensated care next year because of Medicaid cuts and the ACA tax credit expiration, according to a September report by the Robert Wood Johnson Foundation.

That means less spending in hospitals. In Mississippi alone, uncompensated care costs are projected to rise 29 percent, or about $251 million.

That will place 23 rural hospitals at immediate risk of closure, second only to Kansas. Over the past decade, more than 100 hospitals have closed nationwide, with 42 more converting to limited-service rural emergency hospitals to survive. Those hospitals are eligible for federal grants.

Rep. Thompson told The Mississippi Independent in August that the impact in his district could be catastrophic. “In one county, there isn’t even a doctor,” he said. “That’s only going to get worse.”

Medicaid has been the artery that has kept many of those hospitals open.

“That payment program has just been a lifeline,” Richard Roberson, president of the Mississippi Hospital Association, told KFF news, adding that the state’s use of direct payments in 2023 increased Medicaid reimbursements to hospitals and other medical facilities from $500 million a year to $1.5 billion.

Though Republicans included a $50 billion fund in the Big Beautiful Bill Act to help rural hospitals and clinics avoid harm from ACA and Medicaid shortfalls, an analysis found that it will only offset about one-third of cuts in rural areas.

Even Mississippians with employer-based and private coverage could feel the ripple effects. When hospitals absorb more unpaid bills, they often shift costs to private insurers, a process that increases premiums for everyone.

For Mississippi, the weeks ahead could determine the future of its deteriorating health system. The state’s poorest residents will already bear the brunt of Medicaid cuts and face an anxious wait as Congress decides whether to extend or end the enhanced ACA tax subsidies, the last healthcare lifeline for many. Other Mississippians who are better covered will also face loss of access due to expected curtailments and closures of rural hospitals that are dependent upon Medicaid to survive.

Image: “Closed” sign (via publicdomainpictures.net)

An objective article. Unfortunately anything involving the government(s) becomes too complex and the objective of helping people gets lost. Fraudulent use of government assistance has caused resentment among middle class tax payers which leads to misguided reactions by politicians. Then there is the Welfare Trap that keeps people from pursueing the opportunity of higher income that would only be taxed away.